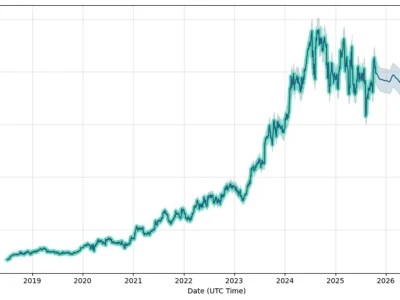

Last Thursday evening, for a few frantic minutes, the script played out exactly as the skeptics had hoped. Apple’s Q4 2025 earnings hit the wire, and the headline was a gut punch: iPhone sales fell short of Wall Street’s lofty expectations. The stock, that titan of the market, immediately stumbled. You could almost hear the collective "I told you so" echoing through the financial networks. It felt like a moment of reckoning, the inevitable gravity finally catching up to a company that had flown so close to the sun.

But then, something extraordinary happened. As Tim Cook and his leadership team began to speak on the earnings call, a strange and powerful reversal began. The stock didn't just recover; it rocketed. It tore past its previous close, climbing over 3% in late trading to shatter its all-time high.

So what happened in that brief window between the numbers and the narrative? The market wasn't reacting to a spreadsheet; it was responding to a story. The initial dip was about the past ninety days. The record-breaking surge was about the next ten years. While everyone was busy dissecting the box score, Apple was quietly showing them the blueprints for a whole new stadium.

The Future is Not on the Balance Sheet

Let’s be clear about what we witnessed. This wasn’t just a stock fluctuation; it was a fundamental shift in how we value a company like Apple. For years, the conversation has been chained to a single metric: how many iPhones did they sell this quarter? It’s a simple, tangible number. But it’s also an archaic way to measure a company that stopped being just a "phone company" a decade ago.

When I saw the stock chart flip from a sea of red to a powerful green spike, I honestly just sat back in my chair and smiled. Of course. The smart money wasn't listening for sales figures; they were listening for signals. They were tuning into the after-hours earnings call—basically, the stock market's late-night session where the real, nuanced conversations happen—and they heard the whisper of something big on the horizon. The chatter wasn't about the iPhone 16s that sat on shelves, but about the vision for the iPhone 17 and the massive December quarter it’s expected to unleash. This was the key takeaway, with many outlets reporting that Apple sees big December quarter driven by strong iPhone 17 demand.

This is the kind of breakthrough in thinking that reminds me why I got into this field in the first place. Judging Apple on quarterly hardware sales today is like judging the potential of the first printing press by how many Bibles it sold in its first month. The real value wasn't the object itself, but the revolution it was about to ignite—a revolution in information, culture, and human connection. Apple isn't just selling you a beautifully machined slab of glass and aluminum; it's selling you a key to an ever-expanding digital universe. The hardware is becoming the ticket, not the main event. What does it matter if ticket sales dip slightly one quarter when the show they grant you access to is about to become exponentially more incredible?

A Symphony of Services

The real story, the one that sent the stock soaring, is about the ecosystem. It’s about the seamless integration of hardware, software, and services creating an experience so fluid and intuitive that it becomes an extension of our own lives. The iPhone 17, from what we can gather between the lines of the call, isn’t just an incremental update; it’s being positioned as the centerpiece of a new, more deeply integrated ambient computing platform—in simpler terms, it means technology that anticipates your needs and fades into the background of your life.

Imagine a world where your devices don't just respond to your commands but proactively assist you, where the transition from your phone to your car to your home is a single, uninterrupted flow of information and context, and that’s the future Apple is building brick by digital brick. This isn't just a fantasy; it's the next logical step, and the market’s reaction shows they believe Apple is the only company with the scale, vision, and user trust to actually pull it off.

But with this incredible power comes an equally incredible responsibility. As we weave this technology deeper into the fabric of our existence, the question of privacy and security becomes paramount. Apple's "walled garden" approach, often criticized for its control, may become its most profound asset in an era where data is the new oil. Can they build this deeply personal, predictive future while still fiercely protecting the individual? Can they be both the architect of our digital world and its most trusted guardian? The answer to that question will define their legacy far more than any quarterly sales report.

The Signal in the Noise

In the end, the market’s wild ride on Thursday wasn’t a glitch or an irrational fluke. It was a moment of profound clarity. It was Wall Street finally catching up to what so many of us have seen for years: that Apple’s true product is no longer a device you hold in your hand. Their product is the future. And last week, they put a down payment on it. The numbers told a story of a single, slightly disappointing battle, but the vision—the quiet, confident vision painted on that call—told the story of who is going to win the war for the next decade of technology. And that’s a story worth betting on.