So, Eli Lilly is basically a money printer now. Let's just call it what it is. The company just dropped its latest quarterly report, and the numbers are so obscene they should be censored. Headlines screamed that Eli Lilly blows past estimates, hikes guidance as Zepbound and Mounjaro sales soar. They didn't just beat Wall Street's expectations; they took those expectations out behind the woodshed and left them for dead. Revenue, profits, guidance—all of it soaring into the stratosphere on the back of two drugs: Mounjaro and Zepbound.

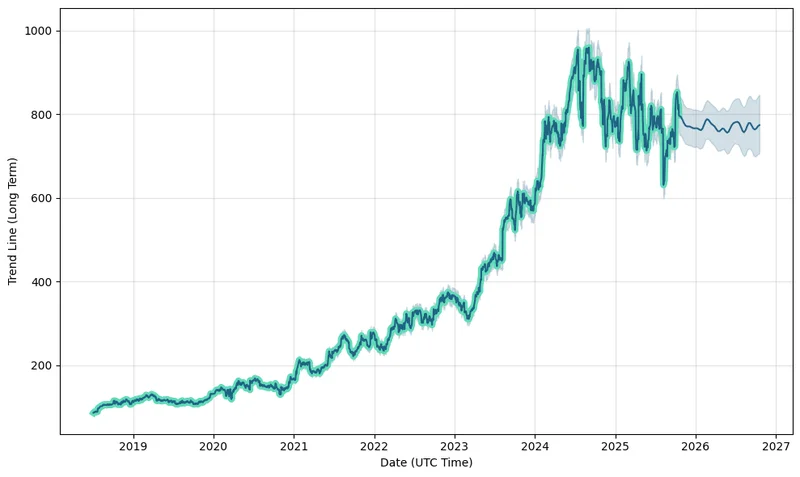

If you bought $1,000 of LLY stock five years ago, you'd be sitting on over six and a half grand today. Think about that. While the rest of us were arguing about inflation and hoarding toilet paper, a pharma giant figured out how to bottle lightning. This isn't a stock; it's a lottery ticket that keeps hitting the jackpot. The market’s reaction was a predictable 3-4% pop, which the analysts called "meaningful but not fundamental." Give me a break. A multi-billion dollar jump in market cap is "meaningful" in the way a tsunami is "a bit of a high tide."

They're telling us the stock is trading near its 52-week high, as if that's some kind of warning. A warning of what? That the money train might slow down? This whole thing feels less like investing and more like watching a rocket launch. Eli Lilly is the rocket, and its GLP-1 drugs are the fuel, burning brighter and hotter than anything we've seen in a long, long time. Everyone on the ground is cheering, mesmerized by the spectacle. But how many people are actually asking where this rocket is headed, or if it has any landing gear?

A Sugar-Coated Pill of Risk

Here’s the part of the story the breathless headlines tend to gloss over. The same analysts drooling over the 37% revenue growth are the ones quietly labeling the stock's valuation as "Very High" and its nature as "Volatile." You don't say. A company whose entire fortune is currently strapped to a new class of drugs that every politician with a microphone wants to regulate might be a tad… unpredictable?

This is a bad idea. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of concentrated risk. We saw a preview of this just a couple of weeks ago. Donald Trump, in a moment of characteristic subtlety, mused that these miracle drugs could soon be "much lower" in price. The stock hiccuped and dropped 3.5%. It was a tiny tremor, but it was a clear signal of the earthquake that could come. The market shrugged it off, but what happens when the political rhetoric isn't just rhetoric anymore? What happens when price controls, IRA negotiations, or some other government hammer actually comes down?

Eli Lilly is trying to get ahead of this, offcourse. They're talking about signing pricing deals and touting a $50 billion investment in U.S. manufacturing. It's a classic corporate PR move: wrap yourself in the flag, talk about jobs, and hope nobody notices you're charging a fortune for a drug that's becoming as essential as insulin. And honestly, it’s a smart play. It's the same playbook every other industry uses when they get too big, too fast. It's like my cable company sending me a "We Value You" email right before they hike my bill by 20 bucks. The gesture is meaningless, but it’s the gesture that counts.

The company's financials look incredible on paper. An operating margin of 43%? A cash flow of $11 billion? These aren't pharma numbers; they're tech numbers from the dot-com bubble. Its just a matter of time before the gravity of reality kicks in. But the market doesn't care about gravity right now. It only cares about up.

The question nobody seems to be asking in these glowing reports is a simple one: is this sustainable? Can a company with a $741 billion market cap—bigger than the GDP of some countries—really keep this momentum going when its core product is in the crosshairs of every populist politician on the planet? They're projecting a stock price of over $1,000, with some analysts even asking, LLY Stock To $1,100? It sounds amazing, but it also sounds like the kind of talk you hear right before the music stops.

Then again, maybe I'm the crazy one here. Maybe this time is different. Maybe Zepbound and Mounjaro are so revolutionary, so culturally transformative, that the old rules of valuation and political risk simply don't apply. They've created a product that taps directly into one of humanity's deepest insecurities, and they've done it with stunning efficacy. Maybe that kind of power transcends the petty squabbles of Washington D.C. and the spreadsheets of Wall Street analysts.

Or maybe it's just a bubble. A beautiful, glorious, money-printing bubble that will make a lot of people rich before it inevitably pops. The company has shown resilience in past downturns, sure, but it's never faced a phenomenon like this. This ain't your grandpa's pharmaceutical stock anymore. It's a cultural movement with a ticker symbol, and those things rarely end quietly.

It's a Hell of a Drug

Let's be real. Buying Eli Lilly stock right now isn't an investment; it's a bet. You're betting that the insatiable demand for a "miracle" weight-loss drug will overwhelm any and all political headwinds. You're betting that the hype can outrun the reality of a sky-high valuation. Maybe you'll be right, and you'll ride this rocket all the way to financial freedom. Or maybe you'll be the guy holding the bag when the fuel runs out. Either way, don't pretend this is anything other than a high-stakes gamble on the future of the American waistline.