Of course. Here is the feature article, written in the persona of Julian Vance.

*

**Exxon’s Earnings Paradox: Why a ‘Beat’ on Paper Couldn’t Beat the Market’s Skepticism**

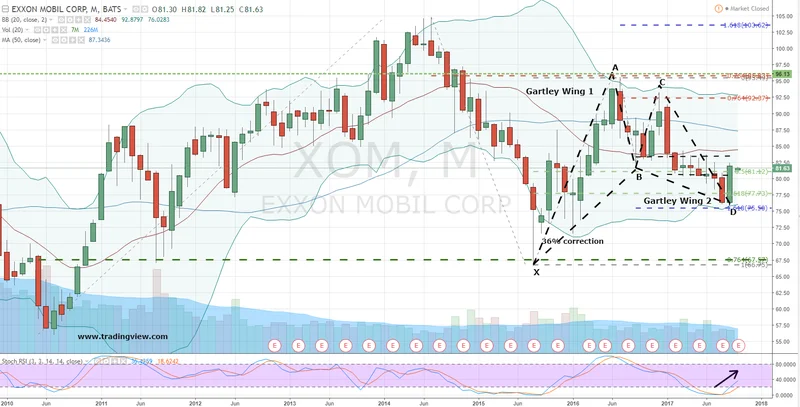

Imagine the pre-market screen at 7:00 AM. The news alert flashes across the terminal: "XOM Beats EPS." In a simpler world, the ticker would flicker green. Traders would price in the operational outperformance, and the stock would climb. But that’s not what happened. Instead, Exxon Mobil’s stock opened weaker, stubbornly, defiantly red.

The immediate question is one of simple causality: Why did the market punish a headline victory? The superficial answer is a revenue miss and lower year-over-year profit. But that’s just reporting the numbers. The real answer is found by looking past the press release and into the cold, hard mechanics of a commodity business in a down cycle. The market wasn't being irrational. It was simply doing the math, and it didn't like the sum.

Exxon’s quarter was a textbook case of a company trying to outrun a deteriorating environment. The market, however, is a forward-looking instrument. It doesn't reward you for running fast on a treadmill that's slowing down. It prices you based on where that treadmill is headed.

Deconstructing the Discrepancy

Let’s lay out the data points. Adjusted earnings per share came in at $1.88, a clean beat over the $1.82 consensus. This is the figure that generates the positive headlines. But look one line down. Revenue landed at $85.3 billion, a significant miss against the expected $86.5 billion (a discrepancy of over a billion dollars). Right there, the narrative fractures. An EPS beat can be achieved through any number of financial engineering levers—cost-cutting, share buybacks, favorable tax rates. A revenue miss, however, speaks to a more fundamental weakness in the operating environment. It tells you the top line is under pressure.

Profit fell to $7.55 billion from $8.61 billion a year ago. This is the absolute reality, stripped of any "adjusted" niceties. The company is simply less profitable than it was. This decline occurred against a backdrop of crude prices sliding roughly 16% this year. That single macro data point is more important than every other number in Exxon’s report.

In the face of this, CEO Darren Woods offered a carefully calibrated defense: “We delivered the highest earnings per share we’ve had compared to other quarters in a similar oil-price environment.” I've looked at hundreds of these filings, and this kind of relative-performance framing is a classic tell. It's an attempt to distract from the absolute decline by grading on a curve. It’s like a pilot telling passengers he’s achieved the best-ever landing during a hurricane. The praise is irrelevant if the plane is still 500 feet short of the runway. Is outperforming a bad environment the same as actually performing well? For a forward-looking investor, the answer is a definitive no.

The market heard the CEO's statement not as a sign of strength, but as an admission of weakness—an acknowledgment that the company is hostage to the commodity price, and the best it can do is manage the decline gracefully.

The Volume-Over-Value Trap

So, how did Exxon try to fight the gravitational pull of lower oil prices? With volume. Daily production rose to almost 4.8 million barrels of oil equivalent—4.77 million, to be exact—up from 4.58 million last year and ahead of Street expectations. This is the core of the company’s strategy: if you’re getting less money per barrel, just sell more barrels.

This is the treadmill analogy in action. The company is increasing its output (running faster) to offset the falling price (the slowing treadmill). This props up the revenue number and helps mitigate the margin compression, but it’s an incredibly dangerous game. It raises a critical question about the company's vaunted "capital discipline." How disciplined is it, really, to ramp up production into a falling market? This strategy is an implicit bet that oil prices will recover, and soon. If they don't—if crude drifts from the mid-$60s toward $60—then Exxon is left with higher operating costs, increased capital expenditure, and even greater exposure to a weak price.

The market sees this gamble for what it is. While management highlights record production in places like Guyana and the Permian Basin, investors are doing the simple math. More barrels at a lower price might keep the lights on, but it doesn't create the kind of free cash flow that fuels buybacks and dividend growth in the long term. It’s a strategy of sustenance, not of value creation.

This isn’t happening in a vacuum. The market will watch Chevron’s results and those of other peers. It will scrutinize refining margins and chemical division performance. But the central tension for Exxon remains unchanged. The C-suite is focused on operational execution, a variable they can control. The market, however, is focused on the price of crude, the one variable they can’t. What happens when a company’s entire strategy is predicated on fighting a force as powerful as the global commodity market?

The Macro Always Has the Last Word

The market’s reaction to Exxon’s earnings wasn't paradoxical; it was perfectly rational. The EPS beat was noise. The revenue miss, the year-over-year profit decline, and the strategy of chasing volume in a weak price environment were the signal. Management can talk about operational excellence and relative performance all they want, but they don't set the price of oil. In a commodity business, that is the only truth that matters. The stock isn’t trading on last quarter’s elegant execution. It’s trading on the brutal, uncertain math of the next four.